Regent Education today announced that it has extended its student-centric financial aid automation suite with the all-new Regent Plan, an offering that will empower higher education institutions to help students borrow responsibly and minimize debt.

Student debt in the U.S. continues to be at a crisis level, with about 43 million borrowers owing more than $1.5 trillion in student loans. Regent Plan provides students with informed, dynamic financial aid planning aids, smart borrowing tools, and improved counseling and contact support to help address this crisis.

Informed, Dynamic Financial Aid Planning Aids

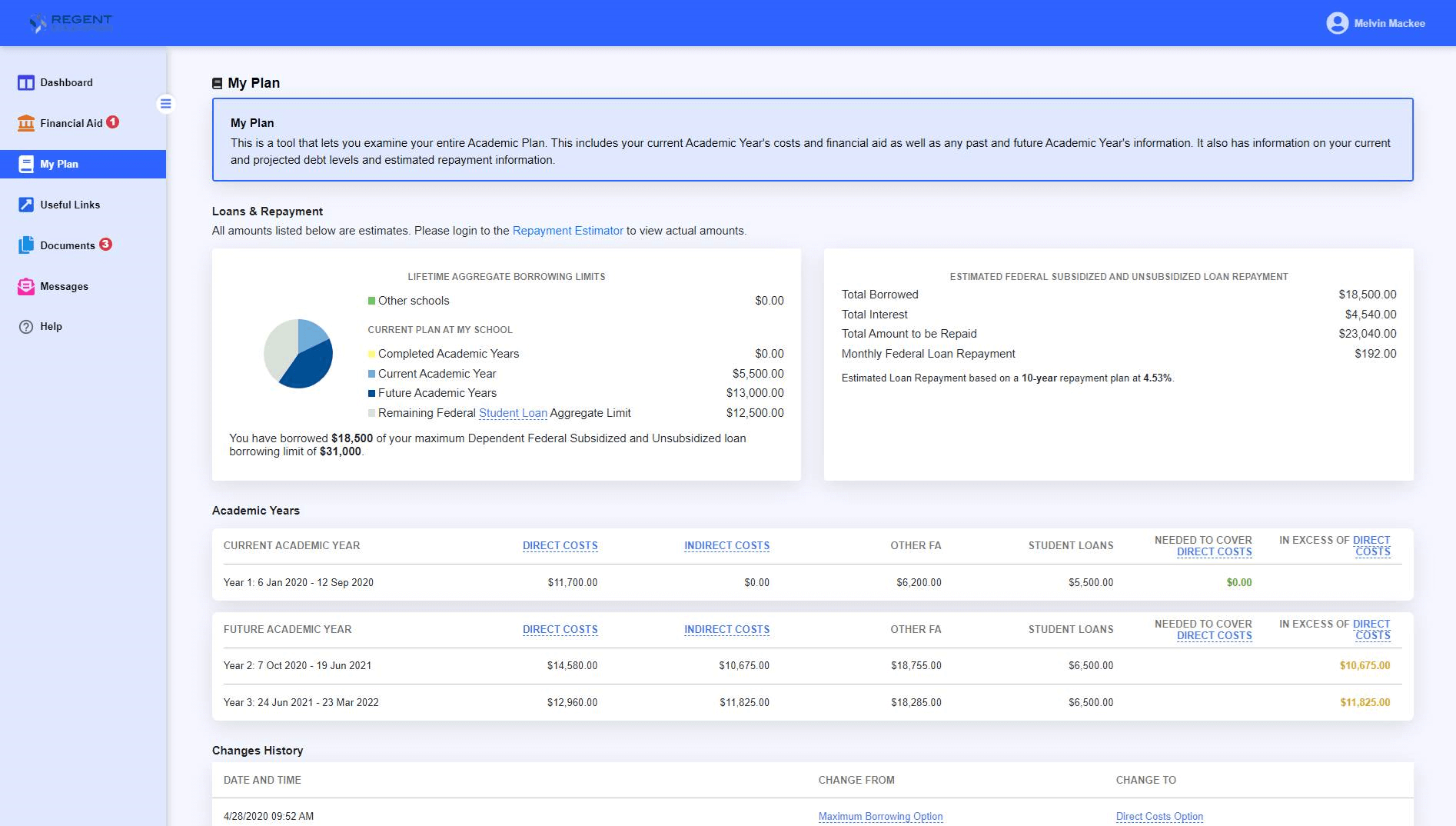

My Plan enables students to plan, forecast, and track their financial aid not only for the existing degree program or year, but also for upcoming ones by:

- Calculating total aid eligibility and out-of-pocket costs for a given program or year and providing an estimated monthly loan repayment plan for optimal decision making;

- Forecasting alternatives using “What if” scenarios like “What if I go part-time v. full time?”;

- Providing visibility into current and projected loan indebtedness as well as remaining eligibility to complete their program or year;

- Informing students of the aggregate loan amounts and their relationship to the maximums; and

- Automatically updating My Plan with actual post-enrollment awarding, progress, and completion.

Smart Borrowing Tools

My Borrowing extends from My Plan and helps students borrow only the amount of financial aid they need. It provides visibility into alternate financial aid packaging options such as Direct Costs versus Maximum Borrowing, so students understand the implications of each. In addition, My Borrowing helps students understand overall debt management for the financial aid year or program, so they can make optimal borrowing decisions.

Improved Counseling and Contact Support

While Regent’s solutions enable student self-service, there are times when students may want to talk to someone about their financial aid. When they do, Advisor Assist adds improved support to the student experience and can reduce call times. It allows an institution’s financial aid counselors or call center advisors to view the student’s financial aid portal interface for real-time, interactive guidance and question resolution.

“With the all-new Regent Plan, our focus was to deliver dynamic, informed planning and forecasting with better financial aid choices and stronger counselor support,” said Ron Dinwiddie, Chief Product Officer at Regent Education. “Our intent is to have an immediate impact on student borrowing decisions that result in lower debt obligations.”