Regent Plan

Help students make smarter financial aid decisions to limit their student debt

Better understanding for smarter student borrowing

The average federal student loan is over $37,000, with the total federal student loan debt balance reaching just over $1.63 trillion at the end of 2022.1

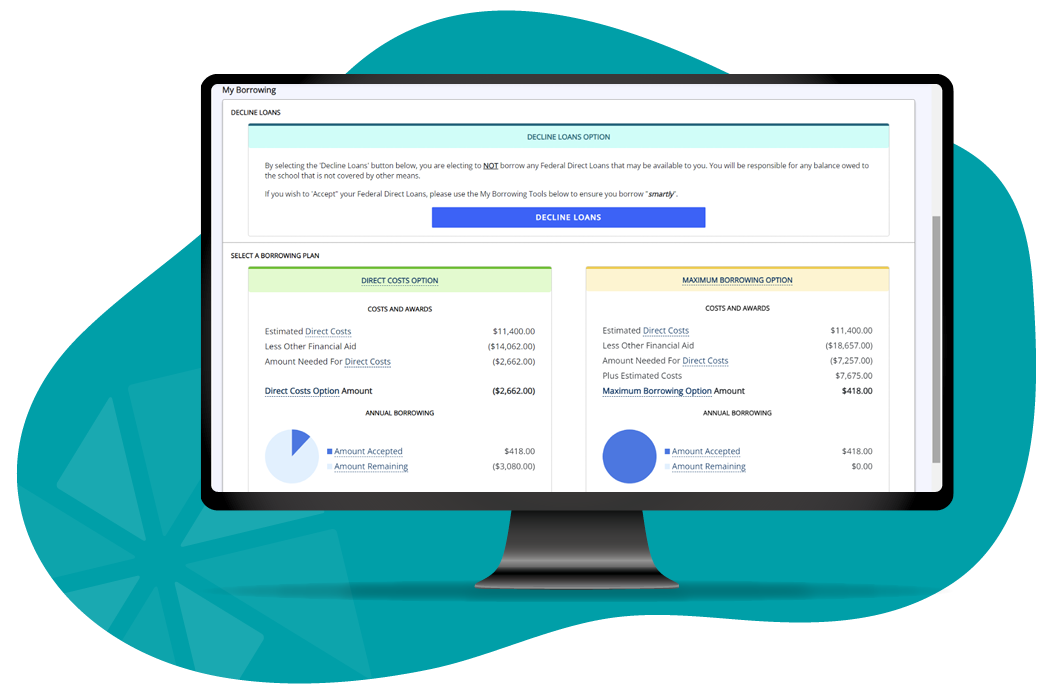

Using Regent Plan, you can make it easier for students to make better-informed decisions about their student loans so they can borrow less. Accessible any time, anywhere, the personalized, integrated financial aid portal enables students to quickly access their financial aid status and take action on outstanding items.

Stats ipsum dolor sit amet

Pretium vel praesent lectus enim ullamcorper consequat fames. Tristique neque adipiscing integer nulla. Est id.

+ 80 %

+ 80 %

+ 80 %

Help students borrow less

With a holistic view of their debt, from first class through graduation, students and advisors can work together to create a financial plan that meets the needs of their financial situation without overextending them.

Give students anytime, anywhere access to their financial aid status

Regent Plan’s personalized, integrated financial aid portal lets students quickly access their financial aid status and take action on items such as accepting financial aid awards, uploading necessary documents, and completing verification for proper aid disbursement.

Helping Clients Reach Their Goals

See how we are helping institutions like you achieve real results.

Maximize your enrollment with automated, flexible, efficient solutions that meet your financial aid needs across all enrollment models.